The purchase of a property is typically financed through a mortgage agreement where the property is financed through borrowed funds from the lender. The borrower is required to repay this loan amount, plus interest, via a predetermined repayment schedule. Islamic finance is based on a belief that money should not have any value itself, with transactions within an Islamic banking system needing to be compliant with shariah . The epitome of financial inclusion is allowing consumers to make financial decisions through multiple product options and channels that meet their needs without compromising their values or wellbeing. This can only be achieved when banks adopt a customer behaviour-centric approach to innovation. The rise of Islamic banking is just the beginning of a much larger discussion around ethical banking and financial inclusion, one which banks have struggled to stay on top of for years, if not decades to now.

There are no significant commercial benefits or features of Islamic home loans that wouldn’t be offered with a non-Islamic-compliant loan. The unique circumstances surrounding an Islamic home loan and the limited size of the market can cause lenders to charge more compared to a typical home loan in the form of profit. Your lending institution may approve your circumstance beforehand, allowing you to immediately choose a home that is within the price range they agreed upon, thereby facilitating your application process. As the Islamic religion forbids borrowing money to be repaid with interest, Aaban approaches a local financial institution that provides alternative forms of lending. The lender conducts a preliminary assessment of Aaban's financial situation and issues a conditional letter of approval on behalf of the funder. “Islamic finance is largely about the philosophical side of things – it’s where Western banking meets Islamic banking.

When they wanted to buy a new car, they saved up and bought it outright. Melbourne couple Zehra and Halis Erciyas withdrew their superannuation from a major fund a few years ago and put it into one managed by a small Islamic finance company. One area the sector is tapping into – with some logistical wrangling – is consumer home loans, like those taken out by Melike and Ibrahim. The moral foundations of Islamic banking For many Muslims, “interest” is something that must be avoided because it is considered prohibited under Islamic ethical-legal norms.

The challenge lies in keeping up with the pace that society is changing — and technology is at the forefront Islamic Bank Mortgage for influencing those societal changes. The Rudd Government is acting to ensure our country is attractive to Islamic financial investment and facilitates greater involvement with this important sector of the global economy. Australia's largest investment bank, Macquarie Group, has also announced plans for an Islamic finance joint venture with the Bahrain-based Gulf Finance House to target markets in the Middle East and North Africa. Australia is well aware of the potential for Islamic finance in developing our nation as a financial services centre.

A seminal book on Islamic finance by the world-renowned Mufti Taqi Usmani, this is a must-read for anyone interested in the key concepts, rules, and ideas behind modern Islamic finance. A brief, useful guide to the principles of Islamic Finance, delivered by an Australia-based authority in the field, Almir Colan. Our terms are competitive with the best finance options available in the open market. With a 30+ year track record, we provide a compelling Islamic finance option for the Muslims of Australia.

Confirm details with the provider you're interested in before making a decision. This alternative method of obtaining a home is designed to better align with Sharia law to offer Muslims a means of pursuing home ownership without offending their religious values. Look for a lender that offers weekly, fortnightly or monthly payments so you can arrange your payments to suit your income.

Shariah-compliant banking

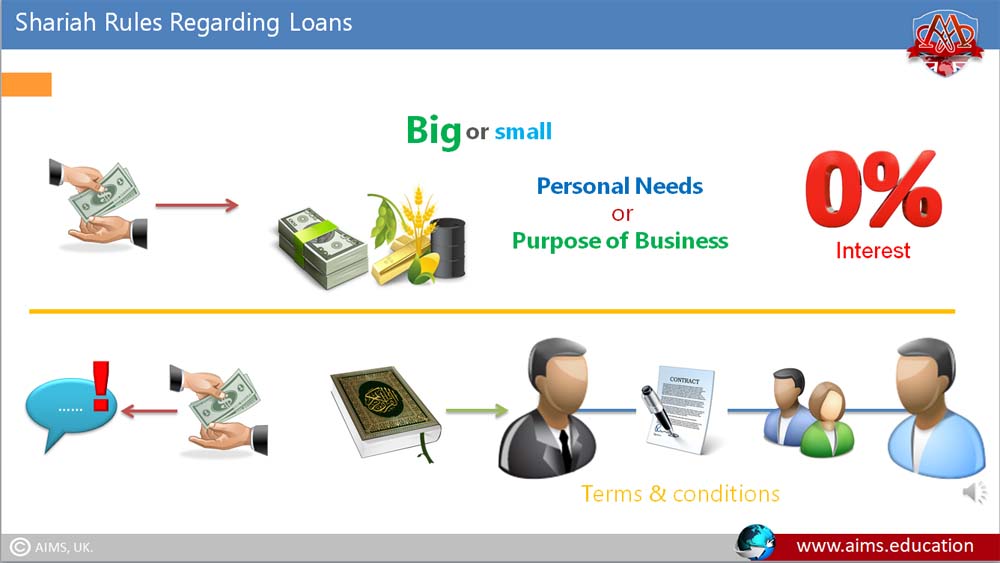

Hejaz wouldn’t exist if it wasn’t for Halal so it is our duty to provide you with authentic Sharia-compliant financial products and services. You will also get an insight into how Islamic financial institutions use the principal contracts to service a wide variety of client requirements, across financing personal and business needs. If you open a Islamic Bank Australia savings account with us, we’ll use your funds in ethical income-generating activities, and then share these profits with you. It’s a totally new way to think about banking,” explained Mr Gillespie. We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here.

Generally, the financial institution will need you to supply proof of your income and ability to meet your rental payments, proof of funds to complete the deposit as well as a minimal rental deposit if you intend to live in the home. The providers of this style of finance all operate under the National Consumer Credit Protection Act and will make independent enquiries into your ability to meet the financial commitments without undue hardship. This often means Islamic finance comes in the form of a “ full doc” application process. The purchase of a property is typically financed through a mortgage agreement where the property is financed through borrowed funds from the lender. The borrower is required to repay this loan amount, plus interest, via a predetermined repayment schedule. Put simply, it is the application of faith-based norms and principles derived from shariah dealing with financial transactions and trade practices.

With a 30+ year track record, we provide a compelling Islamic finance option for the Muslims of Australia.

For many people the fundamentals and workings of Islamic Finance is either unknown, intriguing or perhaps even misunderstood. This is the case in many Muslim majority countries where Islamic finance is flourishing and emerging. Insha Allah over the next few months I want to present a series of lectures/webinars where I hope to deal with this subject and much more that’s happening in the world of Islamic Finance. The Assistant Treasurer also visited Deloitte's Islamic Finance Knowledge Centre in Bahrain and addressed a national roundtable of key figures from the Islamic finance industry in the Gulf region.

The authorisation will allow the bank to continue building its systems and processes before it begins testing with a small number of customers in 2023. We are small-sized, faith based community organisation and are seeking a Finance Manager to join our welcoming and enthusiastic team. Thank you Insaaf and team for helping me sorting out my vehicle finance.

When Professor Ishaq Bhatti came to Australia 30 years ago, the bank teller looked bemused when he asked for a savings account that didn’t accrue interest. Under Islamic law, or Sharia, there is a prohibition on charging or paying interest, which is called riba and considered exploitative because the lender does not assume a share of the risk. When Professor Ishaq Bhatti moved to Australia to do his PhD in 1987 he went to the bank and explained he was a Muslim and needed a savings account that didn’t accrue interest. Speaking to The Adviser on the occasion of the RADI being granted, Islamic Bank Australia chief executive Dean Gillespie outlined that the bank will look to distribute home finance through the broker channel, as well as direct.

Islamic Home Loans Learn and compare

Islamic home loans come with many of the features that are also offered with traditional home loans. Compare the features among different lenders before deciding which home loan is right for you. For the period of the transaction, the buyer amortised the outstanding debt through rental instalments. With an Islamic home loan, you can choose the home and then the financial institution will buy it from the seller. This same financial institution then agrees to lease the home for a pre-determined period, which is known as Ijarah Muntahiyah Bittamlik.

Over time, the rent and profit on share purchases paid to ICFAL can change depending on market forces on the real estate market. These rates are reviewed every 3, 5 or 10 years depending on a member’s request. Finder.com.au has access to track details from the product issuers listed on our sites. Although we provide information on the products offered by a wide range of issuers, we don't cover every available product or service.

He recently acquired a car, but to avoid buying it through finance, ended up leasing it, which was more expensive and meant he didn’t actually own the vehicle. To get into the housing market, he sees little alternative to a conventional mortgage. Among both Muslim and non-Muslim Australians the proportion of people owning with a mortgage was about 37 per cent, indicating many Muslims are already accessing non-Muslim financing methods. Meanwhile Islamic Banking Australia – a group of Muslim Australians and industry veterans – have applied for a licence for a digital bank that is totally sharia-compliant.

The requirements to apply for Islamic home finance are similar to those of a traditional mortgage application. Essentially, applicants will need to substantiate their income in order to demonstrate their borrowing capacity, and provide proof of their intended deposit. The assessment process will consider credit history, employment details, dependents, expenses, liabilities, and property details. Notably, being of Islamic faith is not a requirement for this process. One area of personal finances that is affected is when it comes to borrowing money to purchase a home.

Driven by our Islamic values and ethos, our Shariah advisors ensure all our products are Shariah compliant. 'Mozo sort order' refers to the initial sort order and is not intended in any way to imply that particular products are better than others. You can easily change the sort order of the products displayed on the page. That’s where Islamic Bank Australia comes in, to offer Sharia-compliant options to those who want it. The Australian Prudential Regulation Authority has officially authorised the first Australian Islamic bank to have a restricted deposit-taking license under the Banking Act.

While there are several foreign banks in Australia, including the Arab Bank and HSBC, few of them offer Islamic home loans. However, Westpac and National Australia Bank have introduced Sharia-compliant products to the market. None of the Islamic financing companies currently offering consumer finance products in Australia are licensed as fully fledged banks.

The couple also intentionally avoids mainstream interest-based loans. When they wanted to buy a new car, they saved up and bought it outright. One of the more prevalent models used in Australia is called Ijarah Muntahia Bittamleek. This is where the Islamic financier buys the house for the client and then rents it to them over a fixed term, generally decades.

NAB launches a first in Islamic business financing

Our car financing product gives you the chance to get your dream car to drive with your loved ones. Switch your Self Managed Super to ICFAL and join a fund of $50 million+ that provides Shariah compliant returns on its investments. Be part of a 4000+ member strong community that finances projects and ambitions through Islamic contracts. And in return get attractive dividends on your investments. ICFAL finances all the products using its members’ funds only.

Commission share on referrals to third party advice providers (mortgage/finance/insurance broker, financial adviser, financial institution, utilities provider or any other third party). Income could be an upfront commission and/or ongoing commission. The commission depends on the amount of the finance, cost of the product or other factors and may vary from product to product. The new Islamic banking technology prototype will allow Australian financial institutions to plug in and provide personalised Islamic services to their customers, across savings and transactions accounts, and lending. The salient benefit of an Islamic finance facility is that there is an ethical overlay applied to it, whereby both loan funding and loan purpose have an ethical requirement. Moreover, the mortgage products can be highly competitive with rates offered by many conventional non-bank lenders, and in some cases, may be cheaper than those offered by non-Islamic lenders.

They also agree to markup an asset, allowing the seller to earn more money. We are licensed to advice on any financial products in Australia and are Sharia Halal Finance In Australia certified by an internationally acclaimed authority. Our shariah-compliant financing solutions are here to help you to meet your property, vehicle or commercial need. I get loan from them to purchase a vehicle for my business. I recommended all in Australia to take loan from them to buy property. Binah who specialise in delivering full scale construction services have utilised NAB’s new Islamic financing product on their latest development.

But Dr Choudhury personally believes adding informal banking, the value of Islamic banking would be about AUD 5 billion. Dr Tanmoy Choudhury, a lecturer at Edith Cowan University in Perth, said the size of Islamic banking in Australia is at least AUD 2.5 billion. Of course, the concept of Islamic banking is gaining importance in Muslim-majority countries, even in many developed countries in the West, and Dr. Hassan is very optimistic about its future success. "But in the Qur'an, Allah has made business lawful. Interest is forbidden not only in Islam, but in all Abrahamic religions, such as Christianity and Judaism," he said.

Islam is not the only religious tradition to have raised serious concerns about the ethics of interest, but Muslims have continued to debate the issue with vigour. Before the couple met, Melike had also previously taken out a traditional home loan with Commonwealth Bank. I have been with Amanah since March 2019 and so far, their service has been superb from the beginning. Even during challenging times like today their post-settlement team are willing to help.

"Every farmer that runs sheep, meat, they are experts on Islamic halal, they know more about it than most people in the Middle East who eats it, because their businesses relies on it," Mr Yassine said. He said Australia's financial industry should follow the lead of the agricultural industry, which he said decades ago made the decision to dominate halal exports. Mr Johnston credited National Australia Bank as being the only major bank to have a specific Islamic-focused financing team. Because the Koran forbids charging interest, financial transactions in the Muslim world have to be structured differently, with assets typically transferred to the financier so they can receive profit instead. The buyer pays rent on the home proportionate to the equity they hold. “Looking to get secure sharia-compliant finance is quite hard,” Mr Karolia said.

Mobiquity noted that currently the Australian Muslim community is growing, with around 1.2 million people. The worldwide Islamic finance industry is estimated to be worth $US3.5 trillion ($A5.2 trillion) by 2024, according to a report launched on Thursday in Australia on the state of the global Islamic economy. NAB’s Islamic Financing contract proposition has come about as a result of a five-year program, which has integrated an Islamic legal framework into NAB’s Standard Finance Agreement. You basically pay equal amounts each week, which represent payment in advance for the next week. "We expect Australia to license online-based Islamic finance in 2021. Then we will really understand the demand for Islamic finance in Australia," he said.

As general manager of Iskan Finance, Russell Murphy states, “For our customers, at the date of settlement, they are registered as the owner. We’ve taken the mortgage from them, and secured a transaction agreement that doesn’t express principal or interest. He wanted to participate in the last property boom but he couldn't find any Islamic financing organisations with enough capital to loan to him in a Sharia-compliant way. Yet, despite making an Australian gastronomic icon, over the years the small business owner has felt excluded from the country's financial system and investment opportunities.

Islamic finance in Australia

RMIT senior lecturer of finance Dr Angel Zhong covers meme stock ETFs as well as provides her thoughts on next year’s economic outlook. We acknowledge the Traditional Custodians of the unceded lands and waterways on which Deakin University does business. We pay our deep respect to the Ancestors and Elders of Wadawurrung Country, Gunditjmara Country and Wurundjeri Country. "Sukuk has already been introduced in many international markets and Australia must be quick to take advantage of the opportunities," Dr Azad said.

He likes to write about money, Islamic Car Finance Australia markets, how innovation is changing the financial landscape and how Sharia Compliant Loans Australia younger consumers can achieve their goals in unpredictable times. Hejaz found that 46 per cent of surveyed Australian Muslims who took out a mortgage did so reluctantly. Forty-three per cent of that figure said that they chose not to hold any additional insurance products because of religious reasons. But he said that with Chinese investment on the wane – a market on which Australia has relied in recent years – Islamic finance could offer a way to bridge that gap, and there were many experts to help guide the transition.

This means you’ll need to provide evidence of funds for your deposit, your savings history, employment history as well as information related to any other assets or liabilities you have. The nature of the lease payments depends on the lease structure that is set out by the lessor. The agreement will also set out what happens to your rental payments when market interest rates fluctuate. Generally, it’s not possible in Australia to provide a fixed rental for the entire term of a mortgage. And at the big end of town, one of the country's largest banks, NAB, is launching a specialised financing product for Islamic business customers, which the company believes is an Australian first for banking. Islamic Bank Australia (islamicbank.au) will be the first Australian bank to offer a full suite of retail and business banking services – all without interest and Shariah-compliant for the first time in Australia.

Invest ethically and get Shariah compliant returns as you move one step closer to your goals. Access our Tools & Resources to help you with your Islamic financing and investments journey. Ibrahim says he'd "one hundred per cent" switch his savings to one if they were licensed. "We've done $100 million in loans, just in the past six months," Hejaz's chief executive Hakan Ozyon says. "The question for them arose whether they could actually undertake the Islamic banking activities within the Australian framework. And the decision was made that that was quite a difficult prospect."

But, according to Amir Colan, “starting a bank from scratch” is difficult and it’s hard for smaller institutions to compete with the big players in terms of expertise. While a uniform regulatory and legal framework supportive of an Islamic financial system has not yet been developed