Take our quick Risk Profile Quiz to find the right investment product for you. For security reasons please DO NOT provide any confidential or account specific information via email. What you need to know as an MCCA customer, or more generally as a member of Australia’s Muslim community or the finance profession. "Our programs have a touch point of over 35,000 young Islamic people, and partners like MCCA will help us continue to grow this work and our unique focus around social inclusion, leadership, and identity."

Depending on the financial institution, Islamic home loans may be slightly more expensive than non-Islamic home loans. However, this will depend on how the financial institution determines the profit made on the sale. No, there is no restriction on non-Muslims taking out Sharia-compliant home loans; however, as there is no financial benefit to non-Muslims, it's not often an option offered to them. The bank has security over the property, which means that if the borrower defaults on their home loan, the lender can enforce a sale of the property to recover the outstanding funds that Islamic Bank Home Loan are owed. Islamic finance is underpinned by Sharia values that are consistent with Islamic legislation. The fundamental principles concerned with Islamic home loans are outlined below.

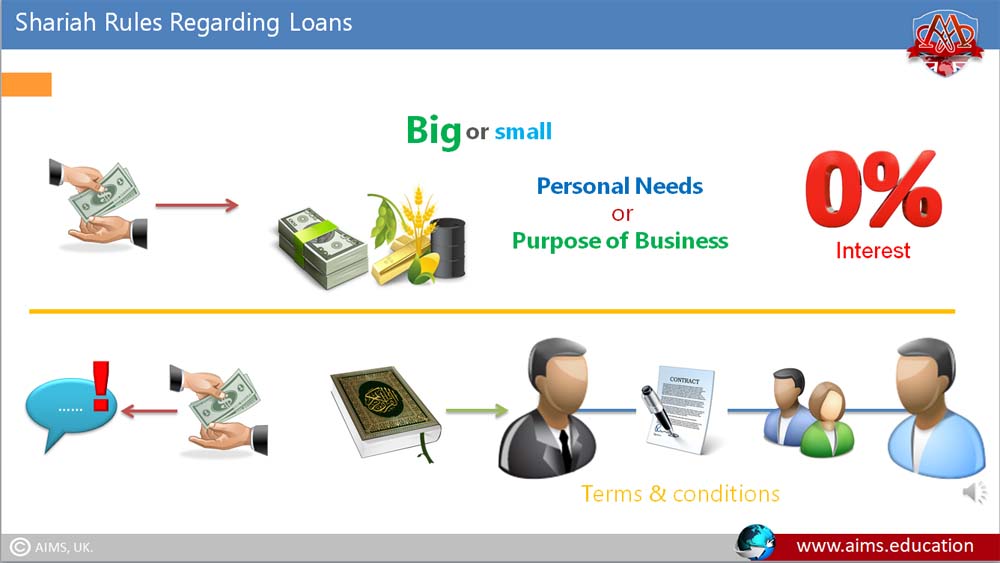

The term ‘Islamic Banking’ is a constituent of ‘Islamic Finance’ and refers to the set of banking and financial rules and practices organized on a basis that excludes interest as a determinant in financial lending and borrowing transactions. The conceptual basis of interest-free banking is to be found in Islamic tenets or Shari’ah. The latter encourages the practice of ‘Profit/Loss Sharing’ as opposed to interest .

But, inclusion isn’t just about access, it’s also about experience. On 26 April, the Government announced that the Board of Taxation would conduct the review recommended by the Johnson Report. This review is to be a comprehensive analysis of Australia's tax laws to ensure that, wherever possible, they do not inhibit the provision of Islamic finance, banking and insurance products. None of the Islamic financing companies currently offering consumer finance products in Australia are licensed as fully fledged banks. That means that while they can offer home loans or super, they can't take deposits from customers. Islamic home loans enable you to finance your property purchase with a different financial product that doesn't accrue interest in quite the same way.

Copies of public submissions made to the Board are available below. Where an Islamic financial product is economically equivalent to a conventional product, the tax treatment of the two products should be the same. We hold a restricted ADI authorisation granted by the Australian Prudential Regulation Authority .

Stimulus programs, including the Building the Education Revolution, are estimated to have contributed around 0.4 of a percentage point to GDP growth for the quarter. While our economy slowed significantly during the global downturn, Australia weathered the crisis better than most other advanced economies. I am delighted to be here today to talk about the future of Islamic Finance in Australia – a topic that is gaining increasing relevance as Australia seeks to become a regional financial centre. We are a Restricted ADI and do not yet meet the full prudential framework, and you should consider this before banking with us once we are open for business. We acknowledge the Aboriginal and Torres Strait Islander peoples as the first Australians and Traditional Custodians of the lands where we live, work and bank.

Overall, very good customer service and will definitely recommend it. They were organised, very professional and have excellent customer services. I have been with Amanah since March 2019 and so far their service has been superb from the beginning.

Australias 1st Islamic bank will distribute through brokers

However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market. Please note that the information published on our site should not be construed as personal advice and does not consider your personal needs and circumstances. While our site will provide you with factual information and general advice to help you make better decisions, it isn't a substitute for professional advice. You should consider whether the products or services featured on our site are appropriate for your needs.

This paper explores the nature and extent of financial exclusion of Muslim community in Australia. Adopting a survey questionnaire method primary data has been used, and Queensland is the selected state for this exploratory case study. While nearly 3 billion people in the world face difficulties in accessing formal financial services and products, in Australian alone, approximately 3.1 million of the adult population are identified as being financially excluded.

With around 1.7% of the Australian population being Muslim, there are limited Sharia-compliant home finance programmes on the market. Islamic home loans are available for many purposes such as construction and purchasing vacant land, although they are not typically used for refinancing. They also come in full documentation and low documentation versions, depending on your leasing needs. More than 6000 interested customers have been “waitlisted” for its launch, Mr Gillespie said. The bank has attracted interest from both Muslim and non-Muslim customers.

After you have settled you will have access to our on-line portal which is a convenient and secure way to pay bills, access your account balance and transaction history and make transfers and redraws. If you are refinancing, the valuation on the property is ordered immediately after you are granted a Conditional Approval. We will order a valuation of the property once you have provided us with a valid contract of sale. We will send you a conditional approval which gives you an indication of how much finance we may provide you. The conditional approval is also subject to certain conditions which may include a satisfactory valuation that is conducted by an independent valuer. We are rigorous about ensuring the Shariah integrity of our products through Shariah audits and on-going testing.

Depending on the financial institution, Islamic home loans may be slightly more expensive than non-Islamic home loans. However, this will depend on how the financial institution determines the profit made on the sale. Although, technically, interest isn’t charged for an Islamic home loan, the financial institution will still be charging fees in the form of rent or profit rate. Make sure you have a clear understanding of exactly how much extra you’re being charged as a result of the profit rate. Murphy stresses that when comparing Islamic home loans, you should keep an eye out for the service level offered by the provider. “Ours is a common mortgage transaction that’s fully functional.

While the bottom line is important, in a world where corporate governance and social impact adds to brand gravity, ethical consciousness must take precedence when developing products and services. Finder.com.au has access to track details from the product issuers listed on our sites. Although we provide information on the products offered by a wide range of issuers, we don't cover every available product or service. To be eligible Islamic home loans, apart from having the Muslim faith, you’ll also need to provide proof of funds for your deposit, savings and employment history as well as information related to any other assets or liabilities you have.

Islamic Bank Australia will initially launch into the retail/personal banking space with an everyday bank account, savings product and home finance before moving into business banking once it has received a full licence. Islamic Bank Australia plans to offer a full suite of retail and business banking services. Melbourne-based investment advisory firm Hejaz Financial Services has also applied for a banking licence after seeing huge demand for its sharia-compliant finance, mortgages and superannuation since 2013. Islamic Bank Australia will first launch retail/personal banking with an everyday bank account, savings product and home finance, before moving into business banking after a full licence is received. The nature of the lease payments depends on the lease structure that is set out by the lessor. The agreement will also set out what happens to your rental payments when market interest rates fluctuate.

APRA grants restricted ADI licence to Australias first Islamic bank

With Islamic mortgages, homebuyers also owe less, own more, but need to pay less rental as the term progresses. The diminishing partnership means they’re gradually buying the financier’s share out as they repay. As they buy more, they pay less to rent the financier’s remaining share until eventually, they own the property in full. Gharār is an important Sharia principle that relates to uncertainty. Islamic borrowers and home loan providers both contribute to the cost of a home and profit or loss based on how it performs within the wider property market. That also helps satisfy Gharār, because they’re also sharing transactional risk.

He recently acquired a car, but to avoid buying it through finance, ended up leasing it, which was more expensive and meant he didn’t actually own the vehicle. To get into the housing market, he sees little alternative to a conventional mortgage. Among both Muslim and non-Muslim Australians the proportion of people owning with a mortgage was about 37 per cent, indicating many Muslims are already accessing non-Muslim financing methods. Meanwhile Islamic Banking Australia – a group of Muslim Australians and industry veterans – have applied for a licence for a digital bank that is totally sharia-compliant.

This means your rent should go down over time, and eventually you’ll have full ownership of the house. To follow Sharia Law, Islamic Bank Australia will follow a lease-to-buy/co-ownership model that acts like paying a monthly rent until you pay off the equivalent of the property’s original price. The income fund will take 1 percentage point of gross profit and is targeting returns between 3 per cent and 4.45 per cent, while returns on the capital fund will reflect the wider residential market. Crescent Finance’s predictions are based on estimates of financing between 1350 and 1650 homes over the next five years, Dr Farook said.

“With the number of Muslims in Australia growing by more than 6 per cent every year, we’re excited to be Halal Finance In Australia bringing this new type of banking to the Australian community,” said Islamic Bank Australia CEO Dean Gillespie. Fixed cost development, licensing and hosting fees for the use of financial calculators, key fact sheets and research. Islamic law says that interest can’t be charged or paid on any financial transaction. Mr Gillespie also said that Islamic banks were inherently ethical, refusing to deal with certain industries. “With the number of Muslims in Australia growing by more than 6% every year, we’re excited to be bringing this new type Halal Car Finance Australia of banking to Islamic Bank Australia the Australian community,” said Islamic Bank Australia CEO Dean Gillespie. Mr Gillespie was formerly Head of Home Loan Distribution at Commonwealth Bank, and Head of Mortgages at Bankwest.

For more information please see Mozo's FSG, General advice disclaimer or Terms of use. InfoChoice, its directors, officers and/or Representatives do not have any ownership of any financial or credit products or platform providers that would influence us when we provide general advice. We may receive fees and commissions from product providers for services we provide as detailed below. Islamic banks are growing rapidly all over the world and offer fundamentally different banking products without interest – such as home finance with co-ownership, and savings accounts that pay profit-share. Australians will have access to these unique deposit products for the first time. Just like with all mortgages and financial products, it’s essential to compare Islamic home loans.

If you decide to apply for a product you will be dealing directly with that provider and not with Mozo. Mozo recommends that you read the relevant PDS or offer documentation before taking up any financial product offer. Target Market Determinations can be found on the provider's website.

Income could be an upfront commission and/or ongoing commission. The commission depends on the amount of the finance, cost of the Halal Loans product or other factors and may vary from product to product. Australia's Islamic bank offering Shariah-compliant banking services including everyday banking, savings products and home finance. We are a Restricted ADI, and are still building our systems and processes.

Some homebuyers mistakenly think Islamic home loans in Australia just make a superficial effort to comply with Islamic law, but that couldn’t be further from the truth. Often, that’s because they see Sharia-compliant products displayed with an interest rate. Sharia-compliant financiers are bound by Australian regulations to show products in this way. Australia is lucky enough to have a growing, vibrant Islamic community and Savvy partners with several lenders who offer fully Sharia-compliant home loans to meet increasing demand.

Australias leading Islamic finance and investments

Look for financial institutions with low or no account-keeping fees, so you can focus on meeting your repayments and paying out your lease in full. The LVR ratio refers to the amount of the property value or purchase price you can borrow from the lender. A loan with a high insured LVR allows you to borrow funds without paying lenders mortgage insurance . The purchase of a property is typically financed through a mortgage agreement where the property is financed through borrowed funds from the lender. The borrower is required to repay this loan amount, plus interest, via a predetermined repayment schedule. And at the big end of town, one of the country's largest banks, NAB, is launching a specialised financing product for Islamic business customers, which the company believes is an Australian first for banking.

Overall, Amanah Islamic Finance is highly recommended for anyone in the market looking for a trusted, Shariah compliant product. Our experienced consultants can help your business reach new heights by offering Ijarah lease agreements to enable your business to acquire or lease assets such as motor vehicles, trucks, plant equipment, machinery & more. Ijarah Finance was established to help you purchase a property without entering into an interest-based mortgage. Our Home Ijarah products can be tailored to suit individual needs. Many investment options in the market are not in line with Islamic principles.

We pride ourselves in engaging with a range of local Islamic scholars and we are the only provider to be endorsed by the Board of Imams Victoria and President of the Imams Council of Queensland . The global coronavirus pandemic may be causing a lot of anxiety and stress for people across Australia. Secure the future of your children by setting aside a fund for them. You can earn returns on the amount as you continue to increase the fund towards a future they truly deserve.

But Islamic banks have made alternatives to traditional insurance available. There are other investment vehicles available to observant Muslims. Muslims can buy shares in a company, including ones that non-Muslims own. The company cannot be involved in any haram practices, regardless of their degree of involvement.

All fees are negotiated with institutions on a case by case basis and may vary between products and providers. Some institutions apply annual account management fees that can bump up the cost of your monthly payments, so look for deals with low or no fees. There’s not a huge number of such products on the market, as the Muslim population of Australia is only around 2.6 per cent, but some of the bigger banks offer loans suitable for Muslims. When considering an Islamic home you will need to think carefully about what you can afford. Different lenders have different rules about the size of deposit they require from you in comparison to the value of the property they will buy.

Purchase a rural property without engaging in an interest-based contract. There are four different types of equipment or asset finance structures that your business can utilize in order to acquire assets such as vehicles, machinery and business equipment. For almost a decade, we have been amalgamating wealth with faith to advance ethical economic growth and financial opportunity for all Muslims.

"We've done $100 million in loans, just in the past six months," Hejaz's chief executive Hakan Ozyon says. "Getting a banking licence is a fairly challenging thing to do in any case, but trying to start an Islamic bank in a country where almost nothing is set up to support Islamic banking is really challenging," he says. "The question for them arose whether they could actually undertake the Islamic banking activities within the Australian framework. And the decision was made that that was quite a difficult prospect." Some time ago, Amanah Finance's Asad Ansari consulted for an offshore Islamic bank that was interested in setting up a branch in Australia. Imran says NAB isn't looking to play in the consumer Islamic finance space.

Australian Muslims Broadly Underserved by Traditional Financial Product Providers

"Hence they are taking steps to do what is necessary to maintain their stand. Australia on the other hand is not exactly a centre for such funds, so I do not see a rapid take-off in that direction." While the Muslim community is growing, it is not completely accurate to describe it as one homogenous group. There are more than 60 countries of birthplace and 55 languages spoken, according to the MCCA. The buyers don't make interest payments, but instead pay rent to the MCCA until a certain point when they are granted full ownership.

If you’re Muslim, then you may have wondered for a long time about how you can get a mortgage so you can own your own home and stay true to your religious beliefs. “One of the great challenges in starting Australia’s first Islamic bank is that you have all of these jurisdictional and legislative challenges that you don’t have when you’re running a conventional bank,” Mr Gillespie said. Mr Zoabi said a block of 25 apartments in Huskisson on the south coast of NSW – all of which had been sold – had been waiting to be developed.

Traditional finance providers are failing to capture the market opportunity due to their business models being based around interest, which is opposed to halal. The survey found that 62 per cent of Australian Muslims would be open to switching at least one of their financial products to an Islamic financial services provider. Islamic banks are growing rapidly all over the world and offer fundamentally different banking products without interest – such as home finance with co-ownership, and savings accounts that pay profit-share. Australians will have access to these unique deposit products for the first time. InfoChoice, its directors, officers and/or Representatives do not have any ownership of any financial or credit products